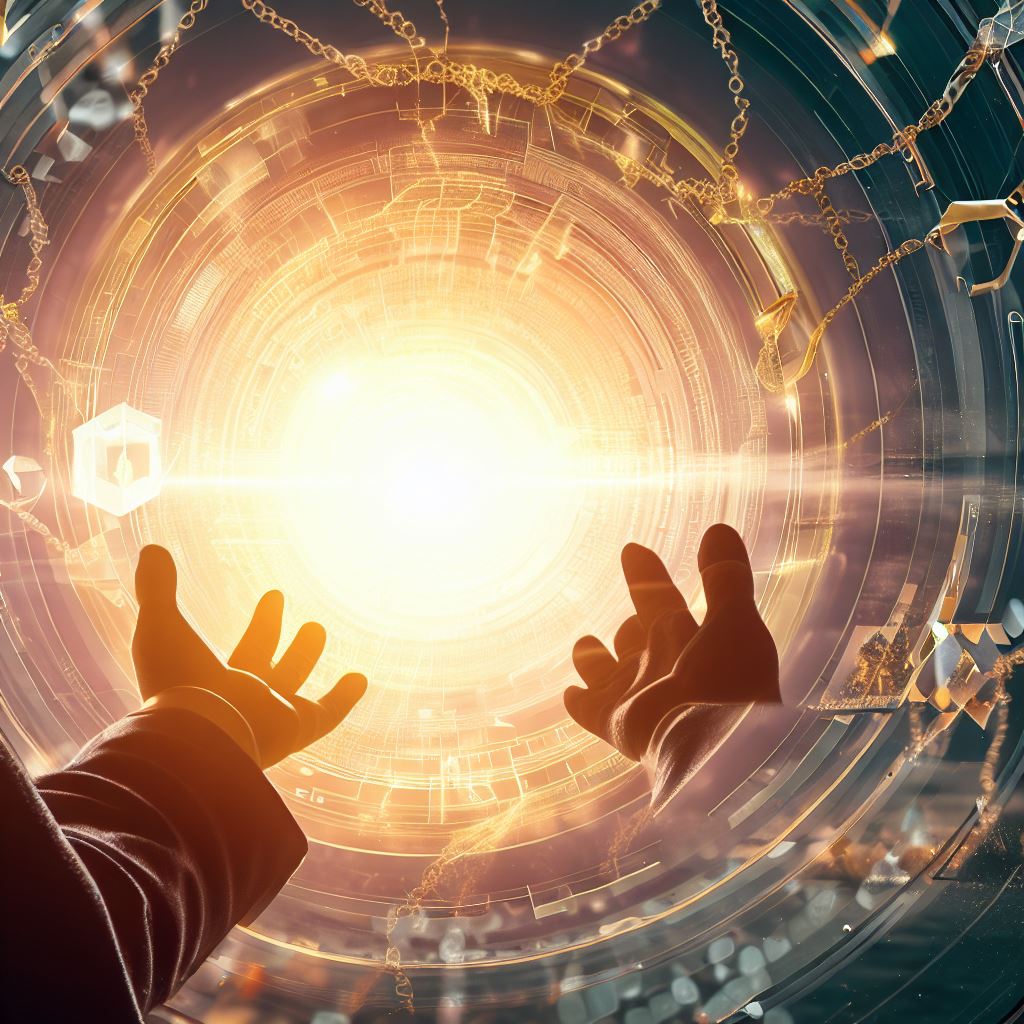

In today’s dynamic digital landscape, trust, security, and transparency are the pillars on which many innovations and industries stand. At the forefront of this transformation is blockchain technology. This comprehensive guide takes you on a journey into the world of blockchain, exploring its origins, intricate workings, diverse applications, pressing challenges, and the boundless future it promises.

Table of Contents

What is Blockchain?

At its core, blockchain is a decentralized and distributed digital ledger that records transactions across multiple computers in a secure and transparent manner. The term “blockchain” stems from its structure: transactions are organized into “blocks,” and each block is linked to its predecessor, forming an immutable and continuous “chain.”

How Does Blockchain Work?

Blockchain’s foundation rests on several fundamental principles:

- Decentralization: Unlike traditional systems with a central authority, blockchain operates on a network of computers (nodes). These nodes collaborate to validate and record transactions, eliminating the need for intermediaries.

- Security: Blockchain employs advanced cryptographic techniques to secure data and ensure transaction integrity. Once a transaction is recorded on the blockchain, it becomes virtually impossible to alter or erase.

- Transparency: Many blockchains are public, allowing anyone to view the transaction history. This transparency fosters trust among participants, as transactions are open and verifiable.

- Consensus Mechanisms: Blockchains rely on consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS) to validate and add new transactions. These mechanisms vary in terms of energy efficiency and security.

Applications of Blockchain

Blockchain technology spans a vast spectrum of applications, including:

- Cryptocurrencies: Bitcoin, the pioneering blockchain-based cryptocurrency, has opened the floodgates for a multitude of digital currencies, each with unique features and use cases. Cryptocurrencies facilitate borderless and peer-to-peer financial transactions.

- Smart Contracts: Platforms like Ethereum have unlocked the potential of smart contracts. These self-executing agreements automate various processes, reducing the need for intermediaries in industries such as finance, real estate, and insurance.

- Supply Chain Management: Blockchain enhances transparency and traceability in supply chains. It helps companies track products, prevent fraud, and streamline operations. This transparency is particularly valuable for consumers who want to know the origins of their purchases, such as the source of their food or the authenticity of luxury goods.

- Voting Systems: Governments and organizations are exploring blockchain for secure and tamper-resistant voting systems. Implementing blockchain in elections can enhance transparency and confidence in the democratic process.

- Identity Verification: Blockchain strengthens identity management and verification, reducing identity theft and fraud. Users have more control over their personal information, sharing only what’s necessary for specific transactions.

- Healthcare: Electronic health records can be securely stored on a blockchain, ensuring patient data privacy and facilitating interoperability among healthcare providers. This can lead to more efficient and secure healthcare systems.

Blockchain in Finance: Revolutionizing Trust and Transactions

Blockchain’s impact in finance is profound. Traditional financial systems often rely on intermediaries like banks and payment processors, leading to delays, fees, and vulnerabilities to fraud. Blockchain-based cryptocurrencies and decentralized finance (DeFi) platforms are poised to revolutionize this landscape.

DeFi projects offer financial services like lending, borrowing, and trading directly on blockchain networks, eliminating intermediaries and their associated costs. This decentralized approach empowers individuals to have greater control over their financial assets and access to a wider range of financial services. It’s worth noting that DeFi’s rapid growth has also brought about regulatory challenges and risks that need to be addressed for the ecosystem to mature.

Moreover, central banks are exploring the concept of central bank digital currencies (CBDCs), which could use blockchain technology to issue digital versions of national currencies. CBDCs could enhance the efficiency of monetary policy, reduce the costs of cash management, and improve financial inclusion.

Challenges and Future Prospects

Blockchain, while promising, is not without its challenges:

- Scalability: Some blockchain networks face scalability issues as they grow, becoming slower and more energy-intensive. Solutions like sharding, layer 2 protocols, and consensus mechanism upgrades aim to address this challenge.

- Energy Consumption: Proof of Work (PoW) blockchains, like Bitcoin, are criticized for their energy-intensive mining processes. Many blockchains are transitioning to more energy-efficient consensus mechanisms, such as Proof of Stake (PoS).

- Regulatory Uncertainty: The regulatory landscape for blockchain and cryptocurrencies varies widely across countries and regions, creating uncertainty for businesses and users alike. Striking the right balance between innovation and regulation remains a challenge.

- Usability: The complexity of blockchain technology and the need for secure private key management can deter mainstream adoption. Improvements in user-friendly interfaces, wallets, and education are essential to drive broader use.

The Boundless Future of Blockchain

The future of blockchain technology is incredibly promising. As it continues to evolve, we can expect:

- Increased Adoption: Blockchain’s applications will continue to expand across industries, from finance to healthcare, supply chain management, and more. New use cases will emerge, driving mainstream adoption.

- Improved Scalability: Ongoing research and development efforts will lead to improved scalability solutions, making blockchain networks faster and more efficient as they grow.

- Energy Efficiency: The transition to more eco-friendly consensus mechanisms, like Proof of Stake, will reduce the environmental impact of blockchain networks.

- Regulatory Clarity: Governments and regulatory bodies will work to establish clearer and more balanced frameworks for blockchain and cryptocurrencies, providing a stable environment for businesses and users.

In conclusion

blockchain technology represents a monumental paradigm shift in how we manage digital assets, execute transactions, and establish trust. Its decentralized, secure, and transparent nature has the potential to reshape various industries and redefine how we interact in the digital realm. As blockchain matures, staying informed and exploring its vast possibilities will be essential in shaping a future where trust and security are paramount. The boundless potential of blockchain technology invites us to imagine a world where innovation and trust go hand in hand, forging a path to a brighter and more secure digital future.